Objective

The purpose of creating the app has been to showcase the automation of the workflow of the company on an online system. Besides, CRM capabilities are allowed to restructure the whole procedure of the credit-related services such as credit score, credit reports, credit analysis, and credit repair progress on one platform to satisfy the client's needs. What's more, it will be easy for the client to get speedy approval of loans and other credit applications in a quick and easy step.

Solution

A single online platform is provided to the clients where they get all the information about their credit report precisely. Moreover, with our effective custom CRM application, the handling of the credit score, managing of the budget and provision of an appropriate solution for credit frauds of the customers has become somewhat easy. Adding up, we work on a SaaS model which could be utilized by companies with similar credit-related facilities to provide the same services to enhance their customer's satisfaction.

About Company

The Credit Pros (TCP) is the aspiring American financial technology firm which is entrusted with finding a solution to the credit-related issues and meeting the expectations of their customers. As per the reports of Inc. Magazine, it is one of the 50 best places to work in the USA. It is BBB Accredited with an efficient "A+" rating.

It provides experts to the customers to save them from getting indulge in the credit-related frauds. Free consultations are offered in multiple languages so to create awareness among the clients about the credit system. It also educates about various steps taken to enhance their credit score.

Key features

- Access 24/7 Hours

- Free Tools and Tips to understand Credit Score

- Easy to Read Credit Report

- Valuable Services at No Additional Cost

- Personalized Score Insight

- ID Theft Restoration and Insurance

- Action Plan from Certified FICO Professional

- Provision of Credit Education Tool

Tools & Technologies

- Codeigniter

- PHP7

- Angular JS

- SmartyStreet

- SOAP

3rd Party APIs

- Transunion

- Sales Force

- Amazon S3

- AWS

- Power Wallet

- Sendgrid

- Desk.com

Frontend UI/UX Design for The Credit Pros

A client-side technology called Angular JS is used as it is based on an MVC framework and use templates to design a completely customized theme from the start, which is then integrated into the given app successfully.

A new concept of three relevant models describes the solution. They are:

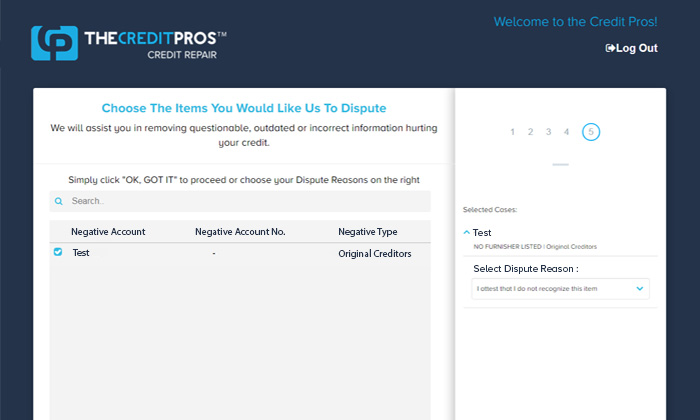

A. Customer Onboard Process

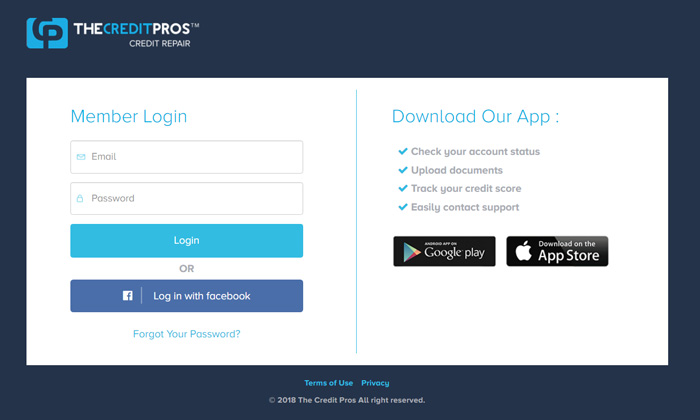

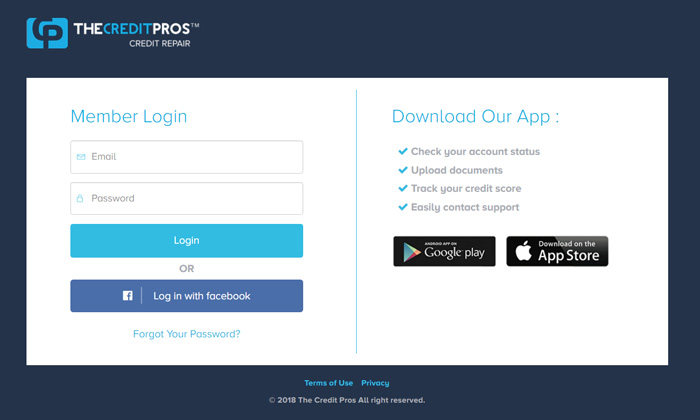

TCP kick off the onboarding process by making contact with their customers through their team of sales executives. Salesforce CRM integrates with the given system to register the customer's data and then forward it to custom CRM for further procedures. After that, an email containing login credentials is received by the client via custom CRM. At last, Transunion API set a questionnaire, and only after completing it; the customers are permitted to complete the given process.

B. Transunion Interview

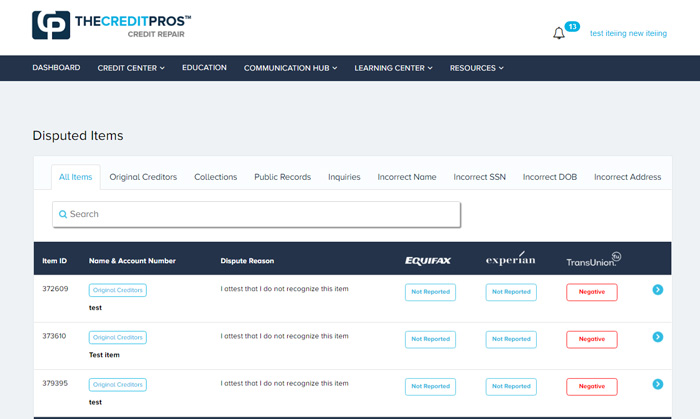

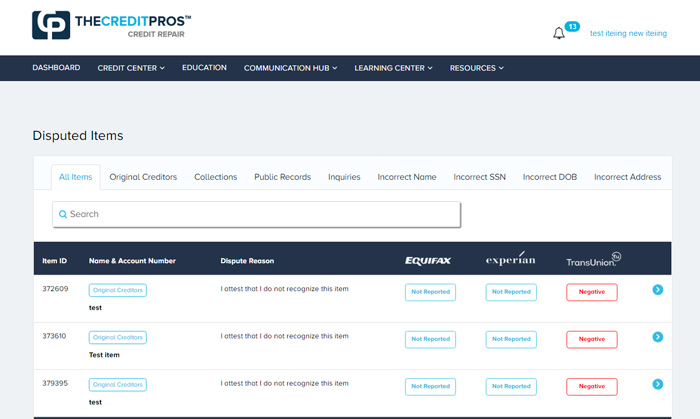

After completion of payment and login, the client goes through the interview via four essential steps in ascending order, namely; signing off agreement, PI update, address verification & TU authentication. The system fetches the report after authentication is successful and displays it on the client dashboard.

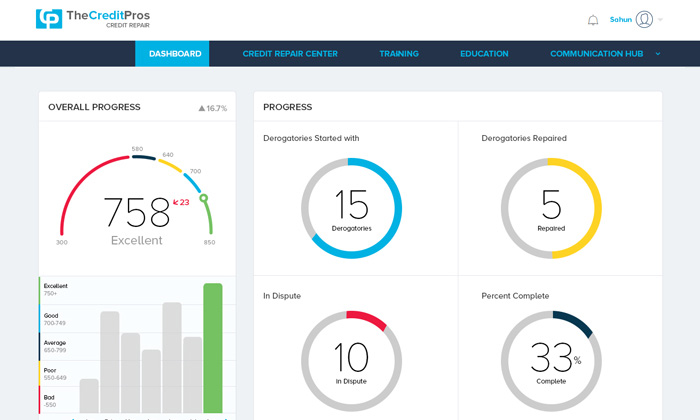

C. Client Dashboard

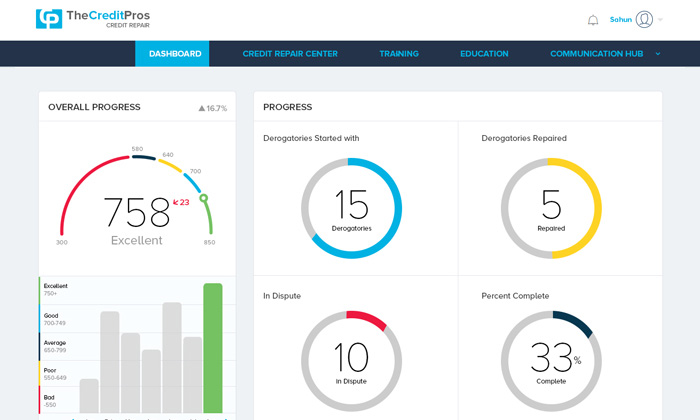

When the interview part is accomplished, all the credit-related information is transmitted onto the dashboard. Afterward, credit-related data (score, analysis, repair progress) & derogatory account mix gets displayed on the client dashboard so to check and bring improvement in their credit score.

Backend Design for The Credit Pros

The frontend is only the small part of the software applications which are visible to the viewers just like the tips of an iceberg. Nevertheless, the vast portion is shrouded in mystery & aloof to the world and is known as the backend design. In the given case, CRM is the background of the backend design, where a high level of secrecy is maintained in improving customers' credit reports. Backend is a portal & handles the management of the client's data with care, which is reflected in the results shown in their credit score.

Codeigniter is cost-effective, easy to use, and open-source web app framework and used for writing codes for backend design. ITExpertsIndya has taken the help of an intelligent backend design to meet the aspiration of customers by providing them accurate information related to their credit report.

These are crucial procedures which are essential for the active backend development:

A. Role-based Login

The log in process in the backend is different as compared to the frontend. Here clients, admins, and managers have their accounts to access the credit report related information.

B. Dashboard

When logins is successful, a dashboard constructively displays the statistics about the current states of the leads, items, clients, and partners.

C. Client Tab

It displays the following aspects on the dashboard:

- List view of the customers registered with TCP

- Search Filters

- Sending SMS or e-mails

- Import Functionality (like CSV & Excel File)

D. Client Panel

This section displays the present clients' view in the form of:

-

Home (Basic & Personal Information)

-

Progress (Graphical Representation of Credit Bureaus' Status)

-

Notes (Notification which is sent to the clients by admin via SMS/e-mail to collect information)

-

Items (Detailed Information about positive, negative, deleted & repaired)

Achievements

The notable achievement of the TCP is that it helps the clients to remove/delete negative items from their credit score and present an appropriate credit report. This results in a reduction in the overutilization and provides satisfaction to the clients.